Resources

You can download each of the resources below by filling out the contact information field of each document. If you would like a hard copy of the document mailed to you, please make that request in the comment section of the information request form when you click on each document.

Are you aware that 64% of Americans do not have a will or an estate plan in place? Legacy Giving Opportunity for Kingdom Impact is an easy-to-understand booklet about estate planning basics and will help you with questions like:

- Do I need an estate plan?

- How will it affect my family?

- How do I get started with an estate plan?

- How will my legacy impact future generations?

To download this document, please enter your name and email address.

Did you know- An estimated 90% of a person's assets are NOT cash and there is a smarter way to give than just giving cash? Planned Giving Opportunity for Kingdom Impact, is an easy-to-understand booklet that can potentially help you:

- Reduce your taxes by giving smarter

- Receive a stream of income from your donation

- Increase the impact of your legacy to future generations after your lifetime

To download this document, please enter your name and email address.

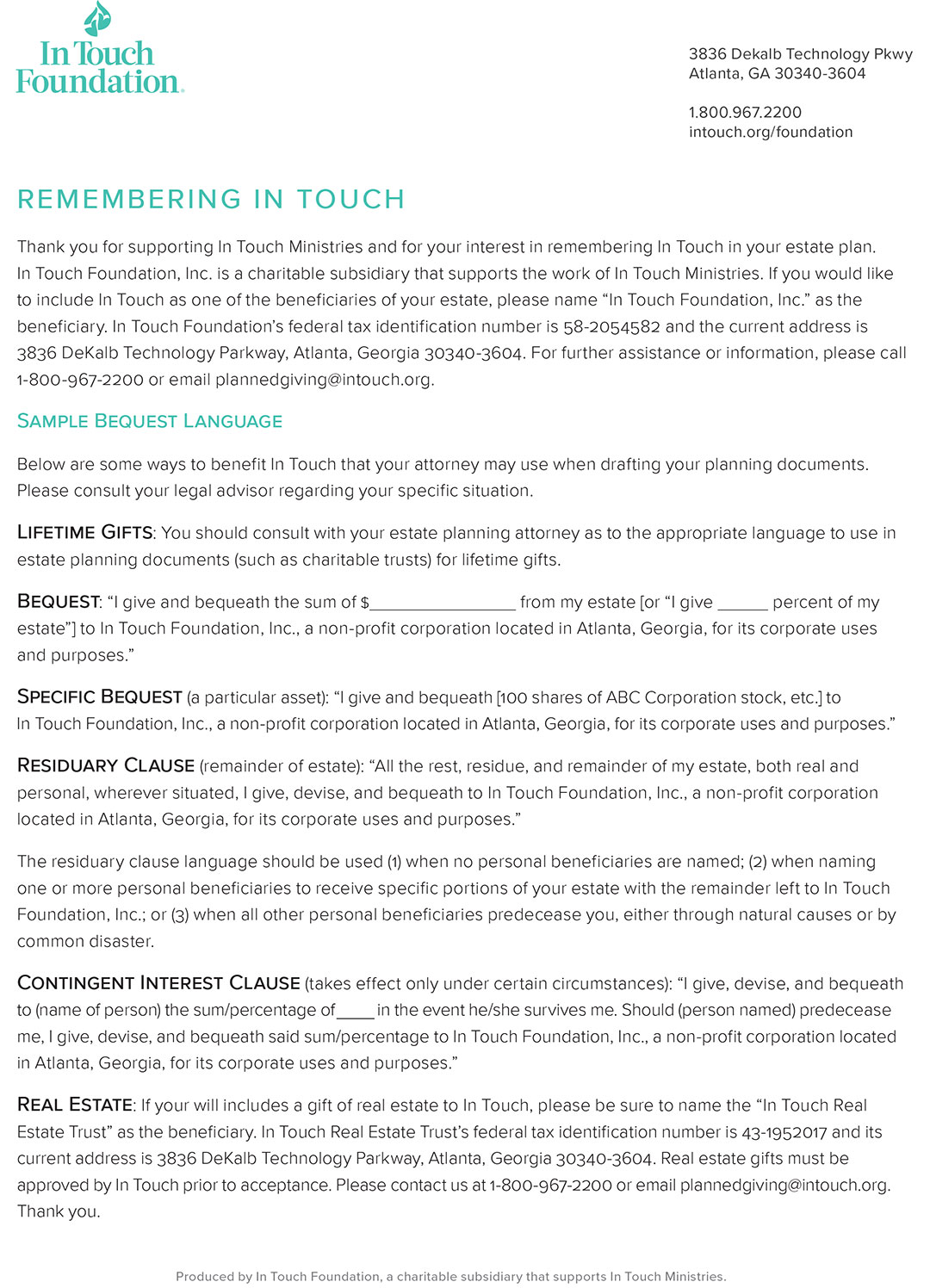

This document provides suggested wording to leave a bequest to In Touch through your will or trust. A bequest is one of the easiest gifts to make. With the help of an advisor, you can include language in your will or trust specifying a gift be made to family, friends or In Touch Foundation as part of your estate plan.

To download this document, please enter your name and email address.

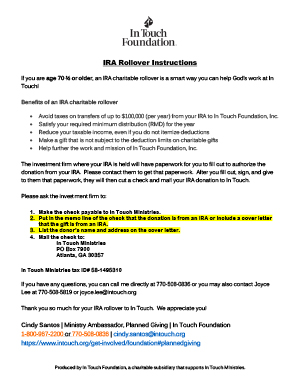

If you are age 70 ½ or older, an IRA charitable rollover is a smart way you can help God's work at In Touch!

Benefits of an IRA charitable rollover

- Avoid taxes on transfers of up to $105,000 (per year) from your IRA to In Touch

- Satisfy your Required Minimum Distribution (RMD) for the year

- Reduce your taxable income, even if you do not itemize deductions

- Make a gift that is not subject to the deduction limits on charitable gifts

- Help further the work and mission of In Touch

To download this document, please enter your name and email address.

Stock Transfer Instructions

Donating appreciated securities, including stocks or bonds, is an easy and tax-effective way for you to make a gift to In Touch Foundation.

Benefits of gifts of stocks and bonds

- Avoid paying capital gains tax on the sale of appreciated stock

- Receive a charitable income tax deduction

- Further God's work at In Touch!

To download this document, please enter your name and email address.